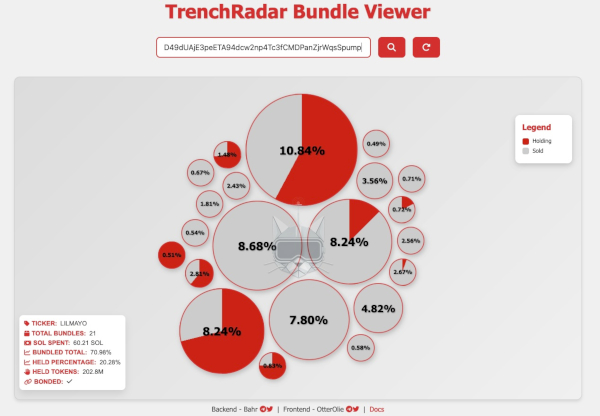

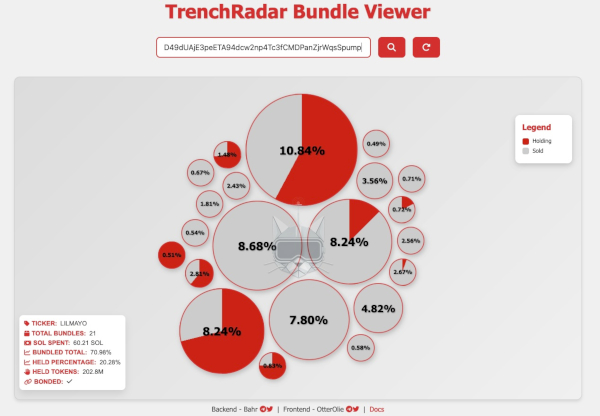

TrenchRadar Bundle Viewer

Bundles – Another Way to Spot Dev Tricks

In order to pull off a successful pump and dump, a scummy developer needs to make their coin look safe and legitimate. After seeding the liquidity, they’ll next need to make buys from some of their personal wallets. This helps pump up the price, creating real buys and interest. They’re using their real money to do this, but unlike you, they got to buy in at the very bottom.

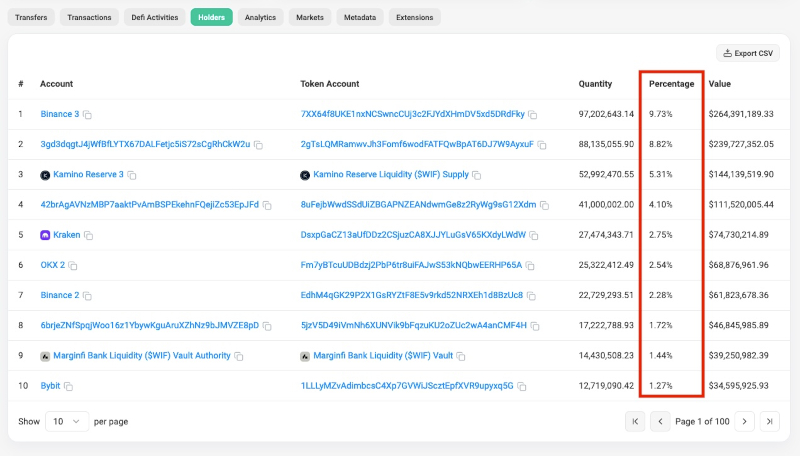

Next, they’ll need to move the coins they purchased to spread out the holder percentage among many wallets (because they know many investors analyze this).

If a small percentage of holders own a large portion of a coin’s total supply, then we know there will be enormous sell pressure. The dev spreading holdings across a fleet of smaller wallets also doubles as a way to inflate the total number of holders. This prevents panic selling when they begin selling their supply because nobody knows how much of the supply they own. Two birds, one stone. They typically also set up fake volume bots to buy and sell among the different wallets I just mentioned.

With all of this buying, selling, disbursing funds across multiple wallets, and bot activity, the dev ends up paying a lot in transaction fees. Even on cheaper chains like Solana, the sheer number of transactions it takes to fool people into buying into their pump-and-dump adds up. We all know some of these devs are rug-pulling for the price of McDonald’s, so if there’s a way to save money on transaction fees, they’ll do it.

Luckily for these penny-pinching devs, something new was introduced to lower transaction fees for people who make a large number of transactions. This innovation is called “bundles.”

What are Bundles?

One of the latest innovations in the Solana ecosystem (and other similar chains) is transaction bundles. Bundles allow users to group multiple transactions together and pay one transaction fee instead of many. The key here is that you can bundle a lot of separate transactions together and pay just a single fee. The transactions still occur in the order they’re submitted.

This is especially useful for traders and bots that need to make a lot of transactions quickly. Volume bots can bundle their transaction fees, and we know scammy devs love using volume bots to fake activity.

Here’s the kicker, all bundled transactions are executed, or none of them are. If one fails, the entire bundle fails.

Bundles are great for the Solana network because they reduce the overhead of many smaller transactions. This relieves network congestion and results in faster overall performance. Another benefit is that it stops front-running since all of your transactions are executed in the exact order you submitted them.

How Pump and Dump Devs Use Bundles

The developers take advantage of bundles by packaging their liquidity transactions together with their swaps (the initial buys). They achieve this by using JITO bundles.

For example:

- Transaction #1: The dev seeds liquidity.

- Transaction #2: They immediately start buying their supply.

This guarantees their swaps are the first ones to go through, allowing them to buy the coin at the absolute lowest price.

Tracking Bundles to Spot Scams

Here’s the amazing part: we can track bundled wallets now and watch them sell their supply. If you see a meme coin with a lot of bundles that haven’t sold yet, then you know there’s significant sell pressure to expect in the future.

By watching the selling activity of these bundled wallets, you can also see how many so-called “community takeovers” are exit liquidity traps for devs to continue selling.

See the image below to see what a chart looks like after the bundles were sold.

Could This Be an Advantage?

In theory, someone could wait to buy a cryptocurrency until all the bundled wallets have sold. However, there’s a downside: once the bundled wallets have sold, the dev usually moves on and abandons all advertisements.

If there’s a community takeover, we could check the bundled wallets to see if they’ve sold yet. If they haven’t, it’s likely that the devs are behind the “takeover” or are aiding it. They may be waiting to dump their supply on new investors who “bought the dip” or on other newcomers.

Many investors use the strategy of buying coins during community takeovers, but often, it was the original devs faking the takeover the entire time, dumping on everyone a second time.

How to Check for Bundles on the Solana Chain

You can check for bundles on Solana meme coins by visiting trench.bot. The coin must be created on pump.fun, and the contract address must end in “pump” for trench.bot to track it.

Final Thoughts

Bundles are a powerful tool for devs looking to manipulate markets, but they’re also a way for investors to possibly detect scams more easily. We can better protect ourselves from being exit liquidity by learning how to spot bundled wallets. It isn’t fool proof, but it’s better than nothing.

Review

- Bundles group multiple transactions into one and save on fees.

- Pump and dump devs use bundles to buy at the lowest price and spread the purchased coins among many wallets.

- Tracking bundled wallets can expose sell pressure and possibly even fake community takeovers.

- Tools like trench.bot help you check bundle activity for Solana meme coins created on pump.fun.

S Taylor is a crypto trader with five years of experience, having navigated a wide range of market dynamics and witnessed numerous scams firsthand. As a former victim of scams, S Taylor turned their focus to blockchain forensics and Solidity Smart Contract development, gaining deep technical expertise in the field. With a unique insider’s perspective, they’ve been involved in various crypto projects, where they’ve seen how developers can exploit vulnerable investors.

S Taylor is also the published author of Meme Coins Made Easy, a comprehensive guide that teaches beginners about cryptocurrency and how to identify and avoid common scams. S Taylor is dedicated to sharing valuable insights and helping the crypto community stay informed and safe.

Disclaimer: This article is for informational purposes only and should not be considered legal, tax, investment, or financial advice.