Official Twitter of $Ball

An ancient relic from the past, the “tax coin” is back! Well, it never really left but we’re definitely seeing a bunch of them trending again on DexScreener. And this time they are on the Solana blockchain.

If you weren’t around during the last bull run (back in the 2021–2022 cycle), you might have no idea what a tax coin even is. Back then, the crypto world saw a wave of what we called “tax tokens.” These kinds of coins were mostly found on the Ethereum and BNB chains.

So what’s a tax coin?

Basically, a tax coin is any token that takes a percentage as a tax on every buy, sell, and transfer.

How Cryptocurrency Tax Coins Work

Let’s say you buy $100 worth of some token that has a 10% tax. The moment you hit “swap,” $10 gets taken out, and you only end up with $90 worth of tokens. That same 10% would come out if you sold or even just sent the token to another wallet. Yeah, even just moving your tokens to another wallet costs you.

That tax gets collected automatically by the smart contract, which is the custom code that runs the token. The contract sends those fees to a specific wallet address that’s built into the code.

Now, what happens to the money after that depends on how the devs coded the token. Some smart contracts are set up to just hold the funds. Others follow instructions like redistributing the money back to holders (kind of like stock dividends), or using it for marketing, or maybe even sending it into a liquidity pool.

I’ve seen some crazy stuff over the years. Some projects used the marketing wallet tax to rent billboards in Times Square or even in Dubai at the Burj Khalifa. Others… just straight up stole the money.

Take Safemoon, for example. The devs said the tax would go toward “reflections,” meaning holders would automatically earn more tokens based on how much they were holding. The more Safemoon you had, the more reflections you got. Some of the devs ended up stealing from that wallet, and a few even went to jail. They are still in the middle of a legal mess even today.

There was even a token I remember where the marketing wallet got close to a million dollars. As soon as it neared that amount, the devs stole it and then dumped the token. They rug pulled the marketing wallet. Not sure if they ever got caught, but probably not.

$Powerball on Solana

So let’s talk about $Powerball, one of the tax coins trending right now.

In this case, the contract takes a 5% tax on every buy and sell. That money goes straight into a wallet called the “pot.”

Here’s the token on Solscan:

https://solscan.io/token/BALLrveijbhu42QaS2XW1pRBYfMji73bGeYJghUvQs6y

You can actually see the 5% tax getting pulled out automatically and sent to the pot wallet. This pot builds up with every transaction and every hour, there’s a drawing.

Here’s how it works:

- For every 10,000 $BALL tokens you hold, you get 1 entry into the drawing.

- So if you bought 50,000 tokens, you’d get 5 entries.

- Solana’s verifiable random function (VRF) picks a winner at random from all the entries.

- The pot wallet holds all the tax funds, and the winner gets the prize.

The smart contract handles all of this automatically. Just like it handled sending the tax to the pot in the first place, it also runs the draw and sends the winnings.

If you want to take a closer look:

- $Powerball contract address:

BALLrveijbhu42QaS2XW1pRBYfMji73bGeYJghUvQs6y - Pot wallet address (where the 5% tax goes):

vEe5tMLKuUXHm6zMZisBiVDMdDfpu4vrZDtrCPyXpot

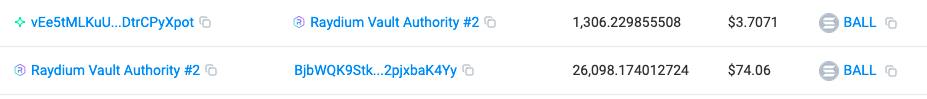

You can actually watch this in action. You can see in the above image where someone made a $74.06 trade. The marketing wallet pulled 5% (because this is the tax) and then sent the 5% ($3.70) to the pot wallet.

Hopefully, that gives you a better idea of what tax coins are, how they work, and why it’s important to know the contract rules before aping into one. Some are fun, some are scams and some, like $Powerball, are just doing something creative with an old idea. I am not verifying that this coin is safe, so DYOR. Here is the tokens Solsniffer page.

$Lotto

Here is another similar tax coin on Solana that is actually older than $Ball and operates similarly. I haven’t looked through this one in detail, maybe you guys can look and tell me?

S Taylor is a crypto trader with five years of experience, having navigated a wide range of market dynamics and witnessed numerous scams firsthand. As a former victim of scams, S Taylor turned their focus to blockchain forensics and Solidity Smart Contract development, gaining deep technical expertise in the field. With a unique insider’s perspective, they’ve been involved in various crypto projects, where they’ve seen how developers can exploit vulnerable investors.

S Taylor is also the published author of Meme Coins Made Easy, a comprehensive guide that teaches beginners about cryptocurrency and how to identify and avoid common scams. S Taylor is dedicated to sharing valuable insights and helping the crypto community stay informed and safe.

Disclaimer: This article is for informational purposes only and should not be considered legal, tax, investment, or financial advice.