A simple infographic explaining how blockchain bridges work, making cross-chain crypto transfers easy to understand.

How Does a Blockchain Bridge Work? A Simple Guide for Beginners

Imagine you have a gift card that only works at one store but you want to shop at another store. A blockchain bridge is like a special exchange counter that lets you trade that gift card for one that works at the store you want to shop at.

In simple terms, a blockchain bridge allows you to move cryptocurrency from one blockchain to another. This is very important because different blockchains have their own unique rules and systems. These different rules and systems make it difficult for them to communicate with each other directly. Each blockchain is basically on an island and we need to build a bridge to reach this hypothetical island.

In this article, we’ll break down what a blockchain bridge is, why it’s useful, and how it works. This article will be written in a way that anyone can understand, even if you don’t have a background in crypto.

Why Do We Need Blockchain Bridges?

Blockchains are like different cities with their own unique laws, currencies, and systems. For example:

Bitcoin (BTC) runs on its own blockchain, which is focused on security and decentralization. Ethereum (ETH) has its own blockchain, which is designed to support smart contracts and decentralized apps (dApps). Solana (SOL) is another blockchain known for being fast and cheap.

Unfortunately, these blockchains don’t naturally communicate with each other. Each blockchain is living in separate digital worlds. A blockchain bridge connects these worlds. This allows you to move assets (like tokens or NFTs) between them.

Example: Why You Might Use a Bridge

Let’s say you have Ethereum (ETH) but want to trade on a decentralized exchange (DEX) that only accepts Binance Smart Chain (BSC) tokens. Since Ethereum and BSC are different blockchains, you can’t just send ETH directly. Instead, you can use a blockchain bridge to convert your ETH into a version that works on BSC (often called “wrapped ETH” or WETH).

How a Blockchain Bridge Works

A blockchain bridge doesn’t actually “move” your tokens across blockchains. Here’s how it works.

Locking the Original Token

When you send tokens to a bridge, it locks them in a smart contract on the original blockchain. This ensures that the same token doesn’t exist on two blockchains at once.

Minting New Tokens on the Destination Blockchain

Once the bridge confirms that your tokens are locked, it creates (or “mints”) new tokens on the 2nd blockchain. These new tokens represent your original ones, but they now work on the new network.

Using the New Tokens

You can now use these tokens as if they were native to the new blockchain. You can trade them, stake them, or use them in DeFi apps.

Bridging Back (Unlocking the Original Tokens)

If you want to move back to the original blockchain, the bridge will burn (destroy) the tokens on the second blockchain and unlock your original tokens.

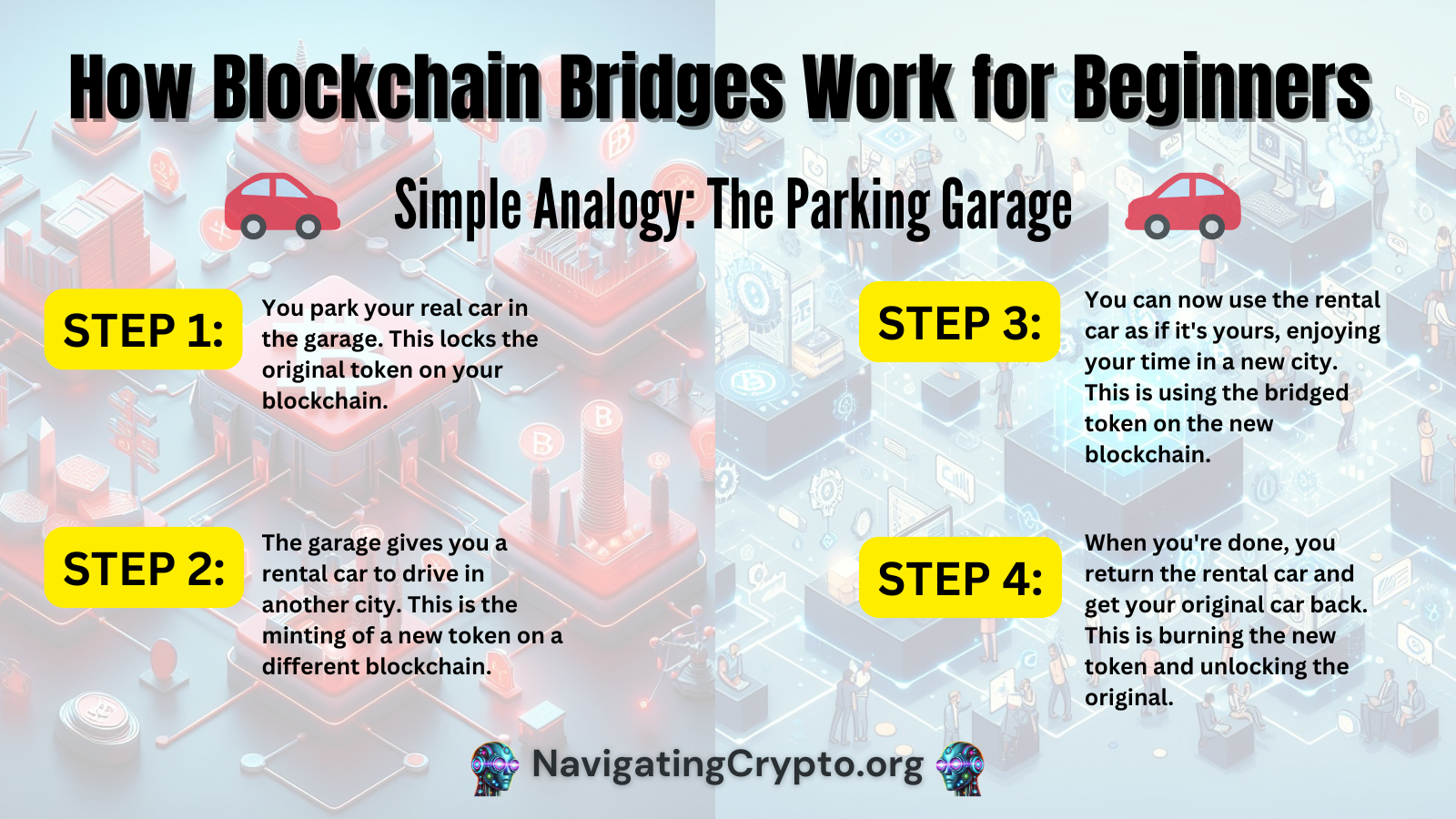

Another Analogy: The Parking Garage

Think of a blockchain bridge like a parking garage for rental cars:

🚗 Step 1: You park your real car (locking the original token).

🚗 Step 2: The garage gives you a rental car to drive in another city (minting the new token).

🚗 Step 3: You can now use the rental car as if it’s yours (using the bridged token).

🚗 Step 4: When you return, you give back the rental car and get your original car back (burning the new token and unlocking the original).

Types of Blockchain Bridges

There are different kinds of blockchain bridges. Each bridge works in a slightly different way. Here they are:

Centralized Blockchain Bridge

- How They Work: A company or organization runs the bridge and holds your tokens for you.

- Example: Binance Bridge

- Pros: Easy to use and usually faster.

- Cons: You must trust a third party to hold your funds and do this safely.

Decentralized Blockchain Bridge

- How They Work: These bridges use smart contracts to lock and mint tokens. This means that no company controls your money.

- Example: Portal Bridge, Synapse Protocol

- Pros: More secure and decentralized.

- Cons: Sometimes slower and harder to use.

Popular Traditional Bridges

If you want to try using a blockchain bridge, here are some well known options:

Binance Bridge – Supports transfers between Ethereum and Binance Smart Chain (BSC). It is a trusted (centralized) bridge, meaning Binance manages the process.

Portal Bridge – Connects Solana and Ethereum. It is a trustless (decentralized) bridge, meaning no single entity controls the funds.

Synapse Protocol – Works across multiple blockchains, offering a trustless way to move assets between different networks.

ChangeNow – Supports transfers between many blockchains and includes built-in swaps. It is a trusted bridge that is beginner-friendly but may have higher fees.

Rubic and Uniswap

Rubic and Uniswap also offer cross-chain solutions, but they work a bit differently than traditional blockchain bridges:

- Rubic – A multi-chain swap protocol that enables cross-chain transactions across Ethereum, BSC, Polygon, Arbitrum, Avalanche, and more. It aggregates liquidity from multiple sources and uses bridges behind the scenes, making swaps more convenient. It is a trusted solution since it relies on external bridges and liquidity providers.

- Uniswap – Primarily a DEX (decentralized exchange), but with UniswapX, it now facilitates cross-chain swaps. Instead of locking and minting tokens like a bridge, it routes trades across chains using third-party bridges and aggregators. This makes it a semi-trusted option, depending on the providers used for execution.

Both are great for swapping assets across chains without manually using a separate bridge. However, fees and slippage should be considered when using them for large transfers.

ChangeNow is a great beginner friendly option because it doesn’t require a separate bridge. ChangeNow automatically swaps your tokens between blockchains. It may have higher fees than direct bridges. If you are lazy like me, then using something like this is a lot easier and faster than many bridges.

Please make sure that you are on an official bridge and always double check those links. There are a lot of fake bridges out there just waiting to scam you. Get links from official souces and always bridge a test amount first. Hope this helps everyone!

S Taylor is a crypto trader with five years of experience, having navigated a wide range of market dynamics and witnessed numerous scams firsthand. As a former victim of scams, S Taylor turned their focus to blockchain forensics and Solidity Smart Contract development, gaining deep technical expertise in the field. With a unique insider’s perspective, they’ve been involved in various crypto projects, where they’ve seen how developers can exploit vulnerable investors.

S Taylor is also the published author of Meme Coins Made Easy, a comprehensive guide that teaches beginners about cryptocurrency and how to identify and avoid common scams. S Taylor is dedicated to sharing valuable insights and helping the crypto community stay informed and safe.

Disclaimer: This article is for informational purposes only and should not be considered legal, tax, investment, or financial advice.