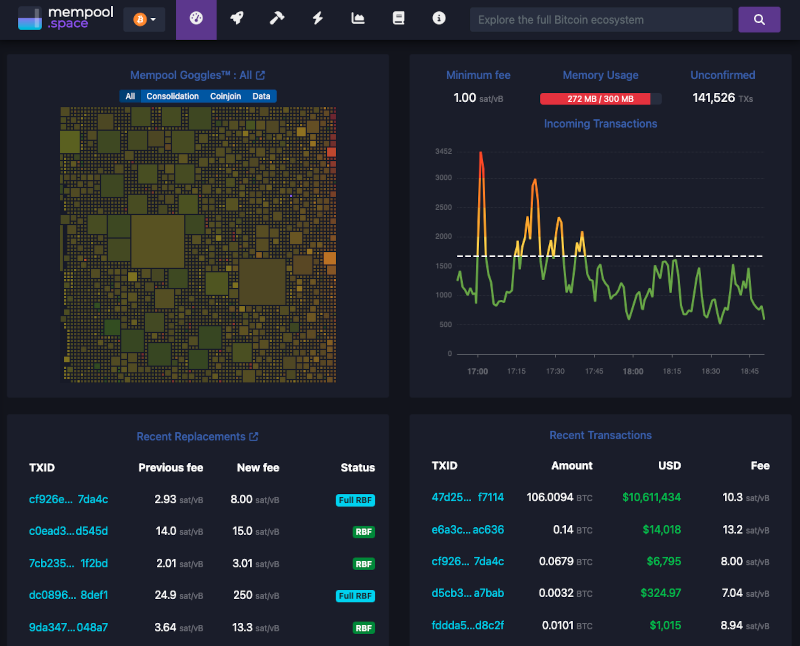

Visual of a mempool for Bitcoin transactions.

What is a Mempool?

Imagine standing in line at a bustling coffee shop, waiting for your order. Your payment is ready, but so is everyone else’s. So, the barista has to handle them one by one. Now, replace the coffee shop with a blockchain, and that line you’re standing in? That’s the mempool.

Short for “memory pool,” the mempool is where unconfirmed transactions gather before they’re added to the blockchain. It’s like a holding area, a place of limbo where transactions patiently (or not so patiently) wait for their turn to be processed by miners or validators. Every blockchain has one, whether it’s Ethereum, Bitcoin, SUI, or Solana.

The mempool isn’t just a neutral space where transactions hang out. It’s a hotbed of activity, especially for meme coin traders. Why? Because it’s not just you and your fellow traders who are watching that line, it’s bots too! And these bots are definitely not sipping lattes while they wait.

How Bots Exploit the Mempool

Let’s break it down.

When you submit a transaction, it’s broadcast to the network and lands in the mempool. Miners or validators will eventually pick it up, but they’re incentivized by gas fees, so they prioritize higher-paying transactions. While this system feels fair in theory, as in you pay more to get processed faster, it instead creates a window of opportunity for bots to swoop in and exploit the system.

Example: You’ve found a meme coin about to take off. You quickly hit “swap” on your decentralized exchange, thinking you’ve found a great deal. But unbeknownst to you, as soon as your transaction hits the mempool, a bot sees it, copies it, and submits the same trade with a higher gas fee. Next, the bot’s transaction gets processed first, driving up the price of the coin. So, by the time your transactions turn comes, you’re paying more than you expected. Or even worse, the transaction fails because the price has moved beyond your slippage tolerance. This is called front-running, and it is just as annoying as it sounds.

For meme coin traders, understanding the mempool is very important if you want to understand what is going on behind the scenes. The mempool is where the game of trading truly begins. Knowing how it works means you can anticipate delays, understand price movements, and protect yourself more from bots.

A Few Strategies

You can’t avoid bot activities completely, but here are a few possible strategies:

- Adjust Your Gas Fees: Paying a higher gas fee can increase the chances of your transaction being prioritized. A higher priority transaction can reduce the chances of front-running by bots. The downfall is that you may end up paying more in gas than being targeted by a front-running bot. This may not be the best idea on an expensive chain like Ethereum.

- Splitting Transactions: Instead of make a gigantic buy (especially on a low volume meme coin), split your buys up into smaller ones. This reduces the likelihood of drawing attention from front-running bots. Smaller trades are less likely to stand out in the mempool and trigger front-running bots. Also if you split up your buys this can help mitigate slippage. This can make for a more stable average purchase price across your transactions.

- Slippage Tolerance: Setting a reasonable slippage tolerance can help make sure that your transaction executes within acceptable price ranges, even in volatile markets.

I hope you understand better now! If you’d like to see what a mempool actually looks like, here’s one that shows the mempool for bitcoin. We will eventually beat these front-running bots.

S Taylor is a crypto trader with five years of experience, having navigated a wide range of market dynamics and witnessed numerous scams firsthand. As a former victim of scams, S Taylor turned their focus to blockchain forensics and Solidity Smart Contract development, gaining deep technical expertise in the field. With a unique insider’s perspective, they’ve been involved in various crypto projects, where they’ve seen how developers can exploit vulnerable investors.

S Taylor is also the published author of Meme Coins Made Easy, a comprehensive guide that teaches beginners about cryptocurrency and how to identify and avoid common scams. S Taylor is dedicated to sharing valuable insights and helping the crypto community stay informed and safe.

Disclaimer: This article is for informational purposes only and should not be considered legal, tax, investment, or financial advice.