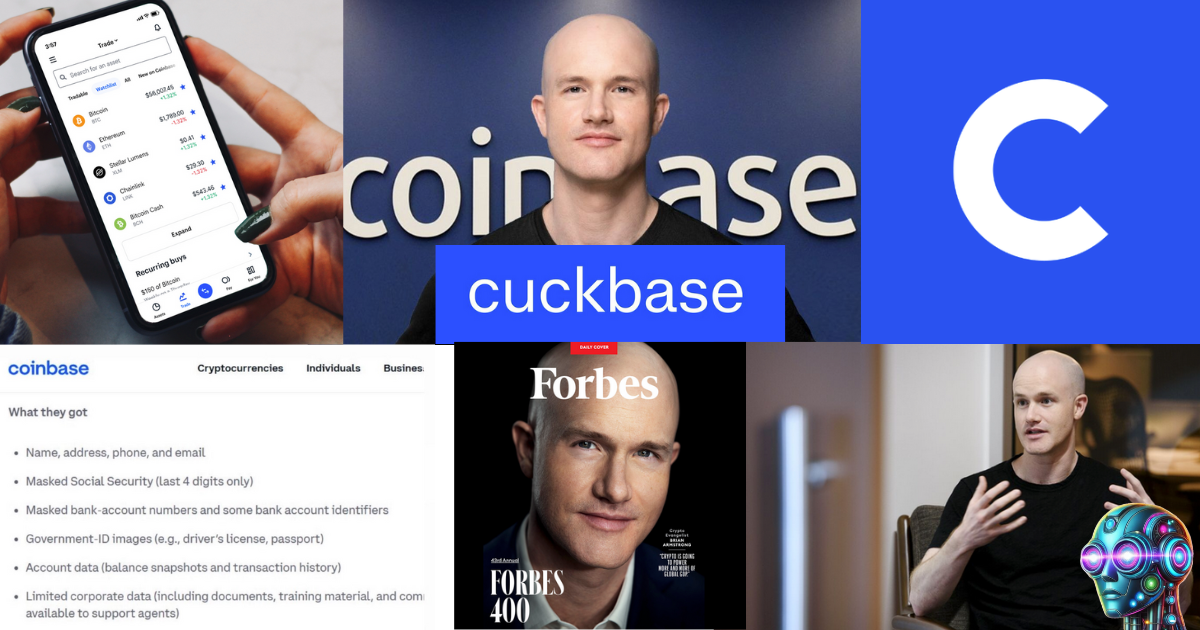

Coinbase confirms a major data breach in 2025 caused by bribed overseas support agents; sensitive customer data exposed.

Insider Bribery Leads to Major Customer Data Theft

Ready for some uninvited guests at your home? Coinbase, the largest crypto exchange (CEX) in the U.S., has confirmed a major data breach caused by bribed overseas contractors. Sensitive customer data, including government-issued IDs and banking details, was stolen and used in attempted social engineering attacks.

What Happened?

A hacker contacted Coinbase on May 11, claiming to have obtained internal documents and private customer information. They demanded $20 million in exchange for not leaking the stolen data. Coinbase refused to pay and instead reported the incident to authorities.

The breach wasn’t the result of a technical exploit. Instead, the attacker paid foreign support staff to misuse their internal access. These individuals, who were not U.S.-based, were promptly terminated once the breach was discovered.

What Data Was Compromised?

While no passwords, private keys, or funds were stolen, the following data was exposed:

- Full names, emails, phone numbers, and postal addresses

- Government-issued ID images (e.g., driver’s licenses, passports)

- Masked bank account numbers and banking identifiers

- Last four digits of Social Security numbers

- Account balances and transaction history

- Internal Coinbase documentation

This information could be used for targeted phishing or identity theft attacks.

Timeline and Detection

Coinbase began detecting suspicious behavior from certain support agents as early as January. Although the breach wasn’t publicly acknowledged until May, internal systems had already flagged unusual activity months prior. Affected users have since been notified, and security monitoring has been increased.

Coinbase’s Response

- Refused to pay the $20M ransom

- Terminated compromised support agents

- Warned affected customers

- Enhanced fraud detection systems

- Launched a new U.S.-based support hub

- Cooperating with law enforcement

Coinbase also announced a $20 million reward fund for information that leads to the arrest and conviction of those responsible.

Financial Impact

The breach may cost Coinbase between $180 million and $400 million in remediation and reimbursements. This includes potential payouts to users who fell victim to scams stemming from the data leak.

Why This Breach Matters

This incident goes beyond financial loss. Coinbase is not only the top U.S. crypto exchange, it also custodies over $122 billion in assets and plays a key role in mainstreaming digital finance. Just days before the breach, Coinbase was added to the S&P 500 Index, placing it in trillions of dollars worth of institutional portfolios.

Is Coinbase Still Safe to Use?

While Coinbase Prime, the institutional-grade service used by ETFs and large clients, was not affected, this breach raises serious concerns about insider threats in the crypto space. Coinbase says no customer funds were stolen and affected users will be reimbursed.

However, this event underscores the importance of:

- Using strong, unique passwords

- Enabling 2FA (two-factor authentication)

- Staying alert for phishing or impersonation attempts

DeFi Is the Future of Financial Freedom

This is exactly why I stand firmly behind Decentralized Finance (DeFi). In countries like the U.S., it’s becoming nearly impossible to enter crypto without using a centralized exchange. That needs to change.

We deserve access to crypto on-ramps that don’t force us to hand over our identities. Governments demanding personal information under the guise of “security” are putting our privacy and safety at risk. DeFi protects your identity, gives you control over your assets, and prevents your funds from being frozen or seized.

Everyone affected by this latest breach is now a target. And until we challenge the overreach of surveillance practices like KYC (Know Your Customer), this won’t stop. KYC is just a fancy term for governments collecting tax-extortion data. Any time a team builds a fiat-to-crypto on-ramp without surveillance—regardless of where it originates—governments either shut it down or hunt the creators down for extradition.

Let’s be clear: This isn’t about your safety. It’s about control and tax revenue.

Keep trusting centralized exchanges, and you’re risking everything. “Not your keys, not your coins.” Brian Armstrong made the right call by refusing to pay the ransom—but the real solution is going fully decentralized.

S Taylor is a crypto trader with five years of experience, having navigated a wide range of market dynamics and witnessed numerous scams firsthand. As a former victim of scams, S Taylor turned their focus to blockchain forensics and Solidity Smart Contract development, gaining deep technical expertise in the field. With a unique insider’s perspective, they’ve been involved in various crypto projects, where they’ve seen how developers can exploit vulnerable investors.

S Taylor is also the published author of Meme Coins Made Easy, a comprehensive guide that teaches beginners about cryptocurrency and how to identify and avoid common scams. S Taylor is dedicated to sharing valuable insights and helping the crypto community stay informed and safe.

Disclaimer: This article is for informational purposes only and should not be considered legal, tax, investment, or financial advice.